Mandatory Prerequisites

Prior to creating a Valuation record, refer to the following Topics:

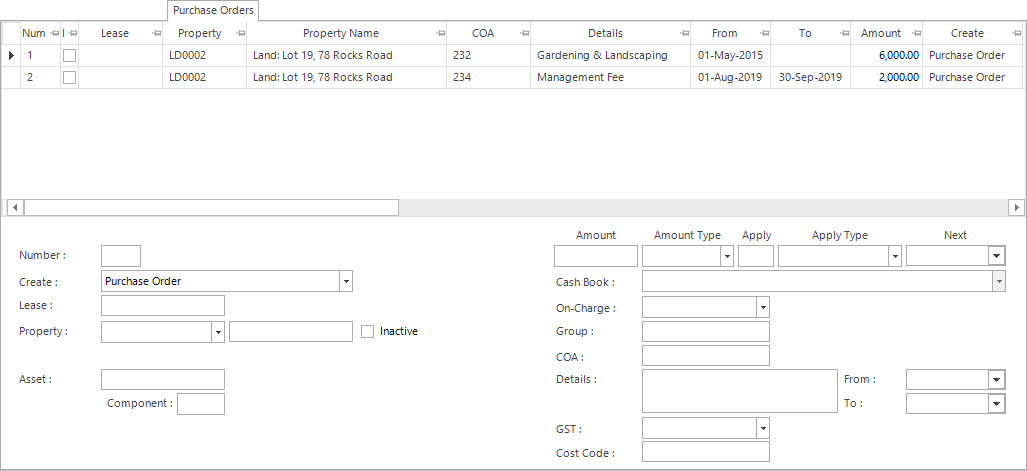

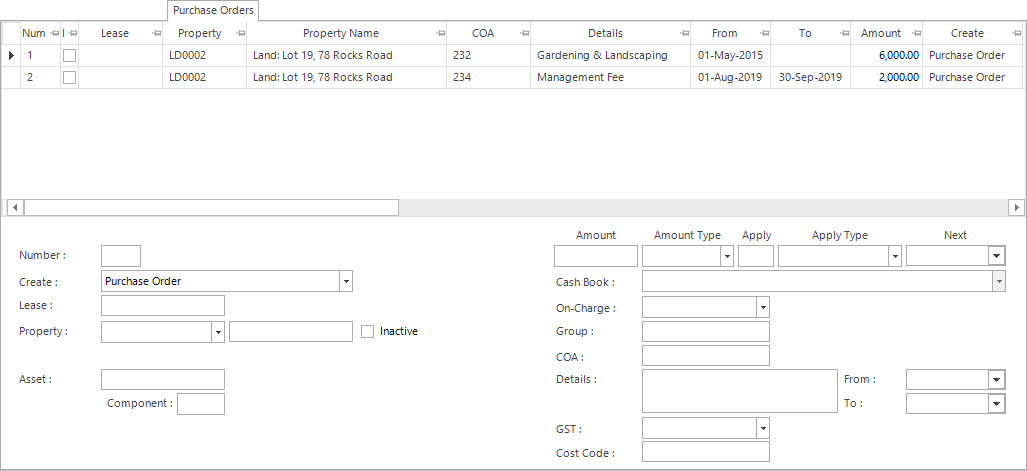

Screenshot and Field Descriptions: Valuations Tab

Purchase Orders table: this displays the Purchase Orders related to the parent entity. Double click a row to populate the fields below the table for editing.

The values in the following fields can be Added, Changed and Deleted using the Maintenance Push-Buttons (Right Hand Side).

Number: this is the number of Purchase Orders attached to the parent entity.

Create: this is the drop down to create a Purchase Order, Transaction or Purchase Order / Transaction.

Lease: this the Lease ID attached to the Purchase Order.

Property: this is the Property type that the Purchase Order is being raised for.

Asset: this is the Asset ID related to the Purchase Order.

Component: this is the Asset Component number related to the Asset of the Purchase Order.

Amount: this is the amount of the Purchase Order. . Note that the value entered is tied in with the value selected in the Amount Type field, ie. if it is an annual amount, or a monthly amount, etc.

![]() Amount Type: this is the how the value is going to be entered in the Amount field. The options are:

Amount Type: this is the how the value is going to be entered in the Amount field. The options are:

![]() Apply / Type: these fields are combined to determine the frequency of the Purchase Order. A numeric multiplier is entered in the Apply field, while the type of period is selected in the When field. The options for the When field are:

Apply / Type: these fields are combined to determine the frequency of the Purchase Order. A numeric multiplier is entered in the Apply field, while the type of period is selected in the When field. The options for the When field are:

If Months(Split/365) or Months(Split/12) are selected in the Apply Type field the value in the Apply field works as follows:

Next: this is date when the next Purchase Order will be raised. This date must be manually entered the first time. The Lease a/c Charges process will automatically update this date from then on.

Cash Book: this is the Bank account if the Purchase Order transaction raised is going to be a Cash Sales / Cash Credit type transaction. Leave blank if a Invoice / Credit Note type transaction is to be raised.

On-Charge: this is how the Purchase Order raised is going to be on-charged. This is only applicable for Landlord type leases.

![]() Group: this is the Contract Purchase Order Group and is used in the Contract Purchase Orders process for grouping purchase orders into the one transaction or separating them out.

Group: this is the Contract Purchase Order Group and is used in the Contract Purchase Orders process for grouping purchase orders into the one transaction or separating them out.

![]() COA: this is the Chart of Account for the Purchase Order transaction raised.

COA: this is the Chart of Account for the Purchase Order transaction raised.

Details: this is the description for the Purchase Order. It will default to the value set up for the COA.

![]() From: the start date the Purchase Order is for.

From: the start date the Purchase Order is for.

To: the end date the Purchase Order is for. This can be left blank.

GST: this is the GST settings for the Purchase Order. It will default to the type set up for the COA.

Inclusive: this check box is to nominate if the value in the Amount field will include GST or not. If this field is ticked, when the GST is calculated, the Purchase Order amount will be reduced by the GST. If this check box is not ticked, the Purchase Order amount will not be reduced and the GST will be added.

GST From: this is a historical field and current use is now irrelevant. It was used during the implementation of GST to allow contractual date based transactions to escape full GST.

![]() Cost Code: this is the Cost Code for the Purchase Order transaction raised. This field can be set as optional, mandatory or not required on the COA set up screen.

Cost Code: this is the Cost Code for the Purchase Order transaction raised. This field can be set as optional, mandatory or not required on the COA set up screen.